The economic growth and income distribution implications of public spending and tax decisions | Bruegel

![PDF] How Redistributive Policies Reduce Market Inequality: Education Premiums in 22 OECD Countries | Semantic Scholar PDF] How Redistributive Policies Reduce Market Inequality: Education Premiums in 22 OECD Countries | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/0170f017b706eb53028a4c6157e54cb0e25d6d98/27-Table2-1.png)

PDF] How Redistributive Policies Reduce Market Inequality: Education Premiums in 22 OECD Countries | Semantic Scholar

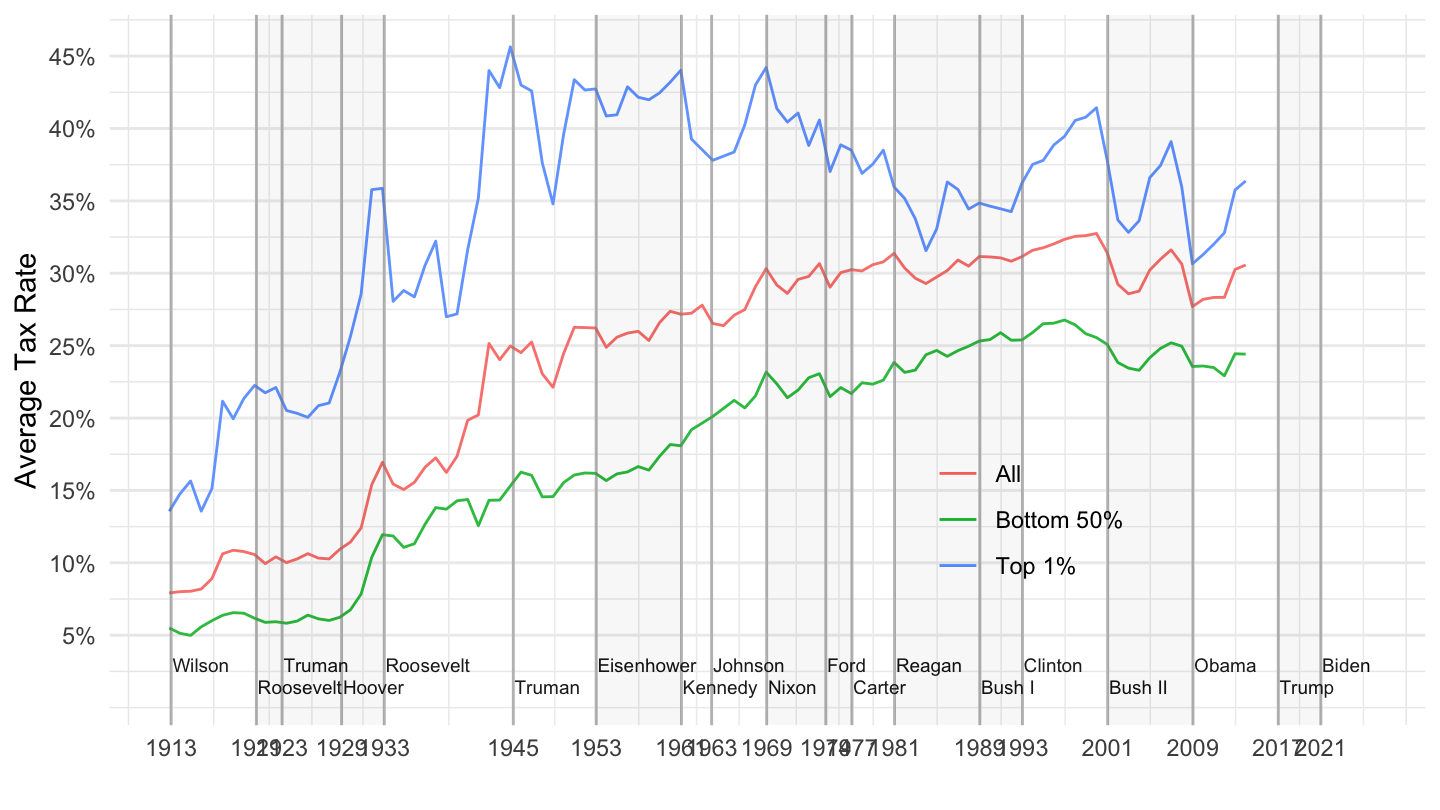

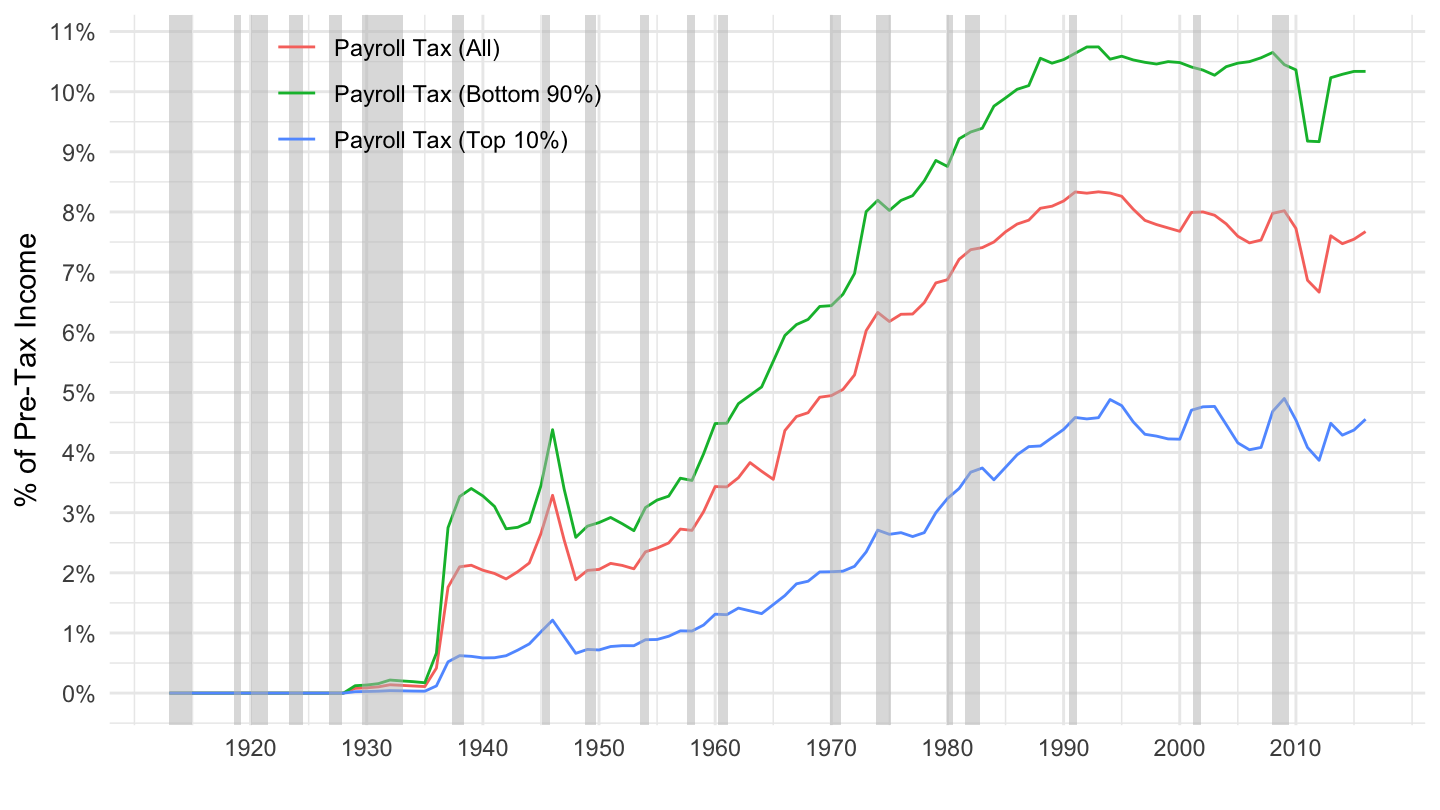

Fiscal Policy and Income Inequality," by David Lipton, First Deputy Managing Director, IMF, Washington, D.C., March 13, 2014

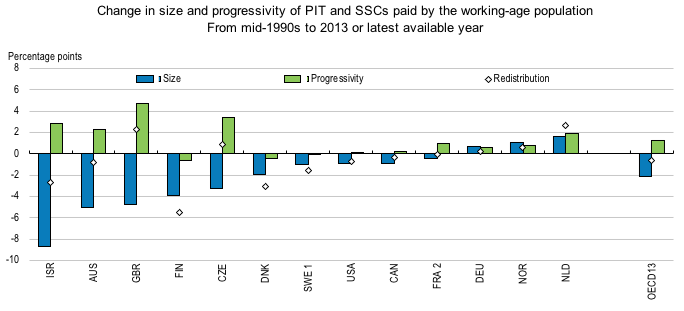

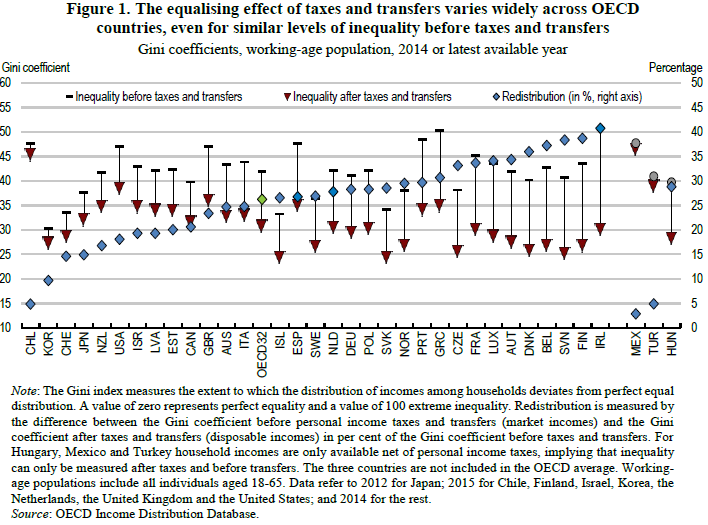

Income redistribution through taxes and transfers across OECD countries EU – Social Protection Reform Project, October 16 Rome Orsetta Causa, Senior. - ppt download

Fiscal Policy and Income Inequality," by David Lipton, First Deputy Managing Director, IMF, Washington, D.C., March 13, 2014